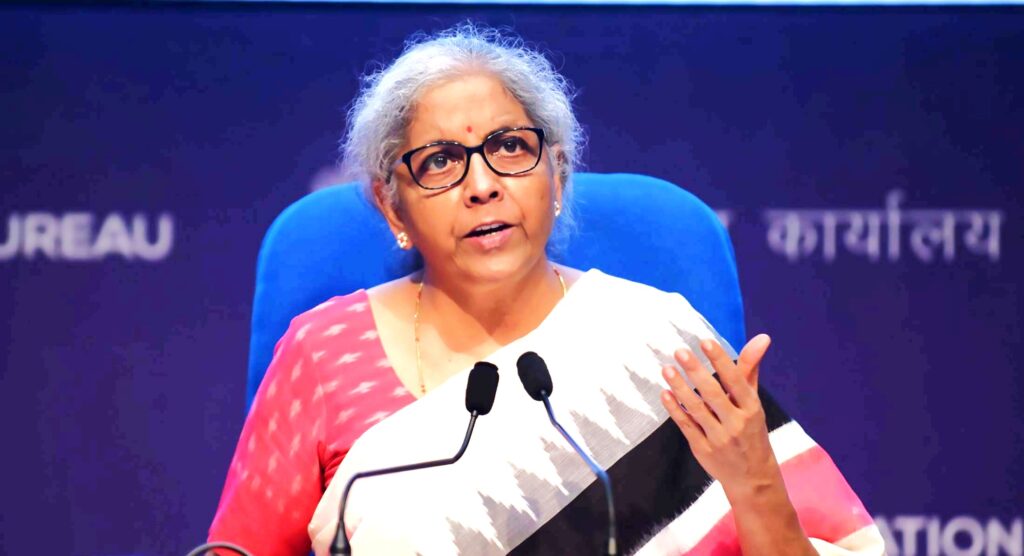

18th November 2024: FM Sitharaman Announces Major Reforms for Affordable Bank Interest Rates”

New Delhi, 18th November 2024 – Aaj ke din, Finance Minister Nirmala Sitharaman ne ek bada announcement kiya, jisme unhone kaha ki India mein bank interest rates ko kaafi affordable banana hoga. Unka yeh statement unki recent press conference mein diya gaya, jo Indian economy ke liye kaafi significant hai.

FM Sitharaman ne kaha ki, “Agar hum apni economy ko sustainable growth dena chahte hain, toh humein interest rates ko reduce karna padega, taaki log zyada borrow kar sakein, aur businesses ko bhi asaani se finance mil sake.”

Interest Rate Reduction: Kya Impact Hoga?

Bank loan interest rates ko kam karna kaafi important hai, especially home loans, education loans, aur business loans ke liye. Isse middle-class aur small businesses ko kaafi faida ho sakta hai, jo abhi tak high interest rates ke chakkar mein apni growth ko slow kar rahe hain.

Home loan borrowers ko kaafi relief mil sakta hai agar interest rates kam hote hain. Aaj kal home loans kaafi expensive ho gaye hain, lekin agar rates reduce hote hain, toh ghar khareedna unke liye affordable ho sakta hai.

Economic Growth Boost Hoga?

Sitharaman ne yeh bhi bola ki affordable interest rates economic growth ko stimulate karenge. Jab log zyada borrow karte hain, toh consumer demand badhta hai, jo ultimately production aur employment ko bhi badhata hai.

“Humari economy ko ab growth chahiye, aur isliye financial accessibility sabse zyada zaroori hai,” Sitharaman ne kaha.

RBI Ka Role: Monetary Policy Mein Changes?

Reserve Bank of India (RBI) ke decisions bhi kaafi crucial honge is process mein. Agar RBI apne repo rates ko cut karta hai, toh commercial banks ko bhi apne lending rates ko adjust karna padega. Isse loans ki affordability badhegi, jo especially small businesses aur individuals ke liye beneficial hoga.

Challenges: Inflation Aur Fiscal Deficit

Lekin, interest rates reduce karna itna aasan bhi nahi hai. Agar rates zyada reduce kiye gaye toh inflation badh sakta hai, jo already ek concern hai. Finance Minister ne yeh bhi acknowledge kiya ki inflation ko control karna zaroori hai, warna price rise se logon ki purchasing power par impact padega.

Fiscal deficit ko manage karna bhi ek challenge hai, kyunki agar government zyada borrow karegi toh debt burden bhi badhega. Sitharaman ne kaha, “Humari priority hai balance banana between inflation control aur economic growth.”

Conclusion: Kya Aage Kuch Bada Hoga?

Aaj ki announcement se yeh clear hai ki Indian government apni monetary policy ko thoda flexible karna chahti hai. Agar bank interest rates ko affordable banaya gaya, toh yeh consumer demand ko badhane mein help karega, aur long-term economic recovery ko accelerate kar sakta hai.

Ab dekhna yeh hoga ki RBI aur government apne policies ko kitna effectively implement karte hain, taaki India ke economic growth ko boost mil sake without affecting inflation levels too much.

Key Takeaways:

- FM Sitharaman ne kaha ki bank interest rates ko affordable banana hoga.

- Lower interest rates will boost demand for home loans, business loans, aur consumer spending.

- RBI aur government ko carefully balance karna padega inflation aur economic growth ko manage karte hue.